“Inside Job” is a 2010 documentary written, directed and produced by Charles Ferguson on the 2008 global financial crisis. It won the Oscar in the “Best Documentary Feature” category in 2011. Notwithstanding, it makes for an enlightening and thrilling watch that every citizen, who cares about where their hard earned money goes, should watch.

This documentary is not an easy watch that one can grab on a lazy afternoon comfortable on their couch. It has complex sounding terms and concepts that should keep one on the edge of their seat. As those financial experts makes the layman believe, “What we do is far more complicated for you to understand so you better leave us alone as we do it.” They are soft-headed people who will make one feel witless and run away with their money. That is exactly what happened in 2008.

Poster of Inside Job

Economics is a fascinating subject

Economics, the “dismal science”, is a fascinating subject because it aims to study the very fondation that runs our society: money. To me, it is a study of resource allocation (More on this in a future post). It is a set of the simplest ideas that sustain our lives. A small section of people deliberately obfuscate those ideas with cooked-up complex terms just to con everybody else.

Concepts at the root of the 08’ crisis that I have broken down to simple language and added examples to make them concrete:

Information assymmetry: It means when a party has more information regarding a transaction than the other party. A rampant example is the real estate industry where the agent has a more intimate knowledge of the market and the value of the property than you do and clearly, they have no incentive to act in your favor.

Incentives: The powerhouse of any transaction in a economy. I have an incentive to educate myself because I know I can earn more money that way. People basically get up in the morning and do any work (even go out and shoot somebody) because they have an incentive. Incentives drives all our actions, even non-economical. (Don’t proceed further if you get offensed easily) Think about your relationships. You may love your partner. But (really) deep down, it’s just an incentive to have something you don’t.

Value: The basic principle why any transaction is carried out is because you are valuable to the other party. Maybe you invented something, maybe only you can offer a service. The idea is, people should be paid proportionately for the value they create in society. Money is a measure and storehouse of that value. It is a token that says, “Yes, this person is entitled to redeem this much worth for anything else”. This is crucial.

That’s all there is at the core of the crisis. So, let’s dig into it.

How it happened?

A newspaper headline in the wake of the crisis

The following is a brief summary of what led to the housing market crash.

- Deregulation in the financial market of the US from the 1980s

Following the Great Depression of 1930s, the financial market of the US was stable and secure due to government regulation. However, during and after the Cold War, few lobbyists started putting pressure on the Congress to deregulate those institutions. What it basically meant was remove restrictions on private banks and firms to use depositor’s (that is, you) money and invest them more freely. It made bankers more greedy and ambitious.

- Explosion of derivatives

Think of derivatives as artificial products that banks can offer you. Traditionally, banks are generally involved in lending and borrowing money. But, bankers can devise creative “instruments” – agreements really, that can allow people to bet on anything. Rising crude oil prices, the bankruptcy of a company, or even the weather. Why? Because they get to keep the service charges. Those institutes began exerting power over the political system of the US and got a law passed that essentially banned regulations on derivatives.

- Securitization

40 years ago, home buyers would go to a willing lender, ask them for money and then repay them on a fixed basis. Naturally, those lenders were very carefully as to who they lent their money.

Securitization is a concept whereby the lender has no fear of not being repaid. They simply sell their mortgages to an investment bank. Consequently, lenders started making riskier loans because they didn’t care if people don’t repay. Loans for over 90% of the home price started being offered.

- Collateralized Debt Obligations (CDOs)

Banks would buy mortgages from lenders, package a lot of them into a CDO, and sell them to investors around the world who would be happy to have a steady flow of cash because who doesn’t pay their mortgages? You see, it’s just the same, boring “I have money. You don’t but you need it. Okay, let me give you my money but you promise to pay me that and some more” packaged in new wrapping foil. Only this time, those mortgages were subprime. Meaning they were bad debt. Those people had over 90% of the home price paid by the mortgage and so had no incentive to keep the house. The moment they couldn’t pay their bills, they can simply walk away because they had no stake in it.

- Rating agencies

These are institutes, Moody’s, Standard and Poor’s and Fitch were the key players at that time, that independently assess a financial instruments risk, returns etc and give them ratings to assist the investor in making an investment in those products. The problem was, the banks were paying these agencies to give AAA, or triple A rating (highest rating, equivalent to a goverment bond in terms of security) to subprime CDOs. Why? Because how else will they sell those rotten apples? Further, the agency had no liability if those CDOs turned bad.

- Predatory lending

Subprime loans carried higher interest rates. So, the banker had an incentive to offer you those products that maximized his profits, not caring if those borrowers would be able to pay those loans. This is predatory lending.

This cycle reinforced one another, pumping out more loans, feeding the bankers. Employees of major banks like Goldman Sachs, Bear Stearns, Merrill Lynch, Lehman Brothers among others were paid “bonuses”. People owned not one, but five houses. Expensive penthouses, private jets. They degraded to drugs. Prostitution was rampant (and these charges were shown as business expenses), among other things. These greedy, bald people saw money, an unrestricted environment to operate, and a way to extract money for practically creating no value. They were artificially creating these instruments that they knew were bad, bribing rating agencies, and selling them off for the profits. But, there is more.

- Credit Default Swaps

AIG, the premier American insurance company, offered others to bet on certain events, such as the fall of a company, or debts going bad, asking them to pay a monthly premium for a return if their bet yielded. Few investment banks saw those CDOs will go bad and started betting against their success and simultaneously selling them off to investors citing they were excellent triple-A products! Moreover, others can speculate on these too. So, if something those CDOs do go bad, AIG is in big trouble. Such chain enforcements blew the crisis out of proportions. There is even more.

After a time, they saw that AIG will go bust trying to repay them after those CDOs go bad which they new were a certainty, so they began to insure themselves for being guaranteed payments from AIG in case the CDOs failed.

The destruction

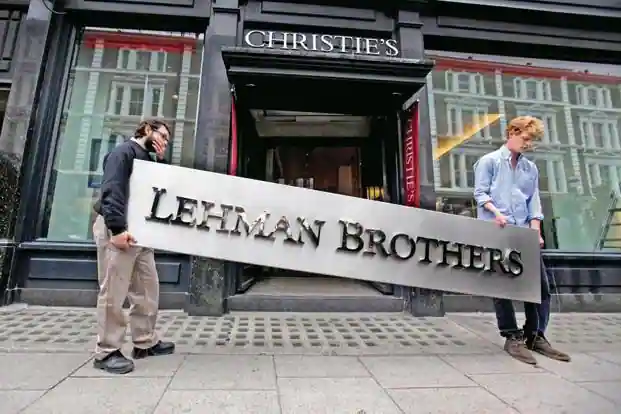

Bankruptcy of Lehman Brothers, one of the major investment firms on Wall Street

People said $x was wiped out from the economy. But that is absurd. How can money be just wiped out in a flash? The truth is, there was no money to start with. Only on paper. There was no value backing that money. It was just a facade conjured by those bankers in their heads. What was the price?

Iceland went bust. Millions of migrant workers in China lost their jobs. Americans lost their savings, jobs, homes. Lehman Brothers dissolved. Stock markets around the world plunged. Nobody was lending any money. The financial system came to a stand still. Yes, pretty horrible for misaligned incentives, ghost value, and people not knowing what the hell they were doing.

From left: Henry Paulson, Chairman of Goldman Sachs and later Secretary of Treasury, US, Ben Bernanke, Chair of the Federal Reserve, and Timothy Geithner, President of Fed Reserve Bank of NY followed by Secretary of Treasury

Who were accountable? What happened to them?

All of them walked home smiling with severance, reimbursements and damages running in the millions. Most still serve on advisory boards, and board of directors of major companies.

Even, academic economists were incentivised to misdirect the community into believing certain facts that weren’t true and got compensated. After all, money runs the world. Not morals.

What is to come and what we should do

I personally believe, overall prosperity (and survival) of everyone depends on equal access to informational and consumer rights. As we enter the second quarter of the 21st century, the world economy will be even more closely knit. Corporations and firms will continue to act in their best interests. Economics and government policies have to stabilise this delicate balance of powers to ensure basic rights and progress for all.

It is only when we, the citizens, have accurate knowledge as to what goes “up there” that we can safeguard our interests, voice our opinions, and strengthen our opposition. The Internet had democratized knowledge and allowed unrestrained access to information for even the remotest sections of society. People must learn to leverage it effectively.

Notes from the Author

I have refrained from naming any person/persons specifically to avoid unnecessary finger pointing at each other. I encourage you to watch the documentary.

I apologise if any of the dates/years mentioned are wrongly quoted. All errors, typographical or otherwise, are my own.

Basil | @itbwtsh

Tech, Science, Design, Economics, Finance, and Books.

Basil blogs about complex topics in simple words.

This blog is his passion project.